Servicers first apply payments to any accrued interest what’s left over goes towards paying down the loan’s principal balance. If you plan to make extra payments, confirm with your loan servicer how the extra cash will be applied. Paying just $50 extra each month could save you thousands of dollars in interest. An additional payment is anything extra you can pay over the monthly minimum amount due. If you plan to make extra payments regularly, enter that amount in the appropriate field. In general, the shorter your loan term, the higher your monthly payments-but you’ll pay less in interest by paying your loan more quickly.

It’s common to see private loan terms that range from five to 20 years. Private student loan terms vary by lender, and you typically select your desired term before you finalize the loan. Federal student loans allow you to change your repayment plan at any time, but doing so will affect the total cost of your loan. For federal student loans, the standard repayment term is 10 years, though under some repayment plans you can take 20 to 30 years to repay your debt. Loan TermĮnter the number of years you have to repay your loan. But know that your results will only be a general estimate-if your rates shift significantly in the future, the total cost of your loan will change accordingly. If you have variable-rate loans, enter your current interest rate into the calculator. While fixed rates are static, variable rates can rise and fall based on certain economic benchmarks. Private student loans, however, usually let you choose between fixed or variable interest rates. Interest RateĮnter the precise interest rate on your loan-a difference of half a percentage point can result in thousands of extra dollars paid, depending on the size and repayment term of your loan.Īll federal student loans come with fixed interest rates, which will never change over the life of your debt. First-year undergraduates can borrow a maximum of $5,500 in federal student loans, while those with private loans can often borrow up to the total cost of their school’s attendance. The amount you borrowed may vary depending on the type of loan you have. Loan AmountĮnter the total amount of your loan, rounded to the nearest dollar. You’ll then see your expected monthly payment and full payment schedule over time. If you have more than one student loan, enter each loan’s details separately-this may mean recalculating multiple times.

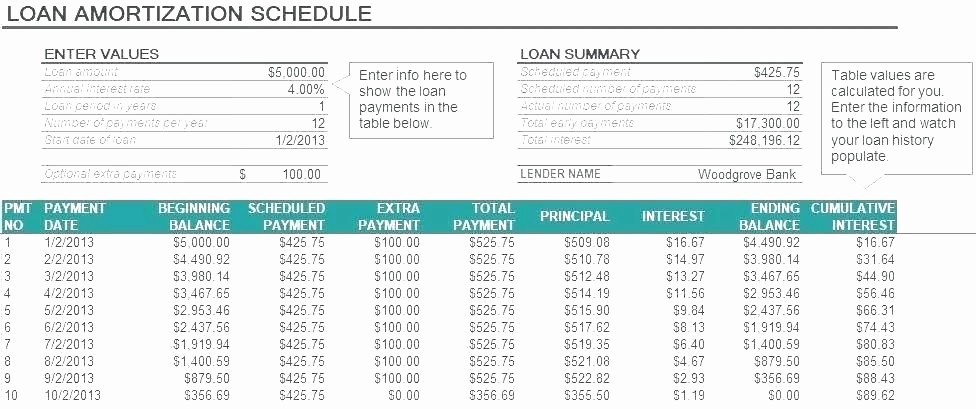

To begin, you’ll need to enter your student loan amount, interest rate, loan term and any additional payments you plan to make.

0 kommentar(er)

0 kommentar(er)